BCCA Speaking Out for Industry

The construction industry contributes 8.6% of provincial GDP and is the biggest employer in BC’s goods sector with 251,707 employees. It’s a vital industry and, due to its scale, is impacted by activities in many areas of our economy and society. Every day, in the midst of much opportunity, contractors are facing challenges to their ongoing and future success.

The BCCA serves more than 10,000 union and open shop companies through the membership of the four Regional Construction Associations, our skilled workforce programs and procurement services.

One of the most important things we do is advocate at the provincial level on behalf of the industry we serve, collaborating with the Regional Associations to support their local issues and the Canadian Construction Association on issues that impact our industry nationwide.

Provincial Budget

BCCA RESPONSE TO BC BUDGET 2021: We understand and fully support the need to budget meaningful financial supports for sectors hard-hit by COVID-19, such as tourism and hospitality. It is essential that our government protect businesses in these industries which are, like construction, crucial to our economy and to so many hard-working British Columbians in communities across the province.

We’re concerned not to see a more significant investment in infrastructure, with only $3.5BN in new spending committed over the next three years. That may seem ungrateful and certainly there is money being spent on infrastructure, but there are two major impediments to the real market impact of this spending.

First, construction costs have escalated at an alarming rate, to the point that bid validity is an enormous challenge in the face of supplier pricing being good for only 7 to 14 days. The drywall market in North America is essentially sold out, lumber and steel costs have doubled. All this means taxpayer dollars won't go as far as they did pre-COVID. In fact, a case can be made to show that the $3.5BN budget increase has already been spent on the increased costs of supply - and then some.

Second, the 3-year capital spending budget of $26.4BN, will be hampered by risk premiums conservatively estimated at $1.32 BN. This cost could be mitigated were BC to follow the lead of other provinces and introduce prompt payment legislation to support contractors in our industry who are faced with cash-flow challenges due to late payments. Given the $8.1BN projected deficit, that premium is something BC taxpayers can ill-afford.

BC’s construction employers and contractors can find value in some of the continuations of supports announced in Fall 2020, such as:

- $150 million for the StrongerBC Increased Employment Incentive tax credit.

- $195 million in funding to continue the Small- and Medium-sized Business Recovery Grant program.

- Budget 2021 more than doubles the number of $10-a-day child care spaces, which means 75 more child care centers and the thousands of families who rely on them will benefit.

- An ongoing PST exemption on capital investments in select equipment and machinery to help businesses pivot or upgrade operations with an anticipated 110,000 incorporated B.C. businesses eligible.

- An average 25% reduction in commercial property taxes 2020.

Although we are always in support of investments in youth and training, especially now with our young talent hardest hit by the COVID-19 pandemic, we see a significant missed opportunity with this budget's lack of focus on career development in our sector. Construction has continued to operate safely during the pandemic and provides many rewarding career paths for BC youth, yet lack of skilled workers remains our number 1 challenge and has been so for more than a decade. We would have liked to see the emphasis on technology and health care jobs complemented by a re-invigorated commitment to the industry that has helped to keep BC’s economy going. The $4 million “continuation of short-term skills training programs for unemployed or underemployed people to train in high-demand sectors, such as construction, technology, health care, and childcare” is welcome but not nearly enough to make a difference.

Construction needs future leaders as much or more than any other industry, and we will watch to see if these new programs will provide meaningful support for our industry’s workforce development needs, which are long-standing and significant.

The construction industry has proven itself to be resilient and adaptable in this time of great challenge. We have been here for British Columbia. But our contractors are struggling with cash flow challenges, increased costs, late payments, and lack of skilled workers. If the budget does not remember us, we hope the Attorney General will so that we can at least get paid on time for the work we do.

During the 2020 budget consultation, BCCA President Chris Atchison once again urged the Select Standing Committee on Finance to prioritize prompt payment legislation in BC. In August 2019 BCCA was advised that its recommendations regarding Prompt Payment legislation were adopted by the Select Standing Committee on Finance and Government Services and included in their unanimous report on the 2020 Budget. The recommendations made were given during this presentation on June 13, 2019 as part of the 2020 Budget Consultations. A previous presentation was given by BCCA President Chris Atchison on September 25, 2018 to the Select Standing Committee on Finance and Government Services as part of their 2019 Budget consultations. Specifically, the recommendation was for the introduction of prompt payment legislation to require payment within a set number of days.

These are the issues that matter most today:

Community Benefit Agreements

Update from August 28, 2020:

On August 28, 2020, the BC Court of Appeal referred the CBA challenge (supported by all major construction associations, progressive unions, and business organizations, who consider it to be a violation of the Canadian Charter of Rights and Freedoms) out of the court and back to the government-appointed Labour Relations Board. This is extremely disappointing: this is not a labour relations issue but a human rights issue. To work on taxpayer funded infrastructure projects, construction contractors should not be forced to get their workers from the government and construction workers should not be forced to quit their current employer, and abandon their existing benefit plans, in order to join a government selected union. The coalition will continue to fight for the rights of BC's construction workers.

Update from July 16, 2020:

The CBA/PLA appeal referenced in our February 3rd update is back infront of the BC Supreme Court starting July 16th at 10 am.

Update from February 12, 2020:

BCCA’s response to the latest news around the CBA/PLA Supreme Court Decision:

“As a Canadian citizen, it's extremely troubling that the BC Supreme Court is disinterested in protecting my right to Freedom of Assembly. And as a provincial taxpayer and father, knowing that we have some of the highest child poverty rates in the country and that our health care system is stressing to point of collapse, I must question the wisdom of knowingly spending $56 million dollars more than necessary on a public infrastructure project, just to support a preferred union.” – Chris Atchison

Update from February 10, 2020:

Fraser Crossing Partners has been awarded the $967.5-million CBA/PLA contract to replace the Pattullo Bridge.

- Total project costs are currently estimated at $1.4 billion.

- Premier Horgan publicly admitted that the budget will be 4% higher directly due to the CBA: this is $56M taxpayer dollars.

Update from February 3, 2020:

Supreme Court Challenge - Setback

- On Monday, Feb. 3, 2020, B.C. Supreme Court Justice Christopher Giaschi clarified his July 2019 ruling, saying that he intended for the Labour Board to address Charter values related to the CBA afterall, not the Court.

- This clarification comes almost 7 months after original ruling.

- However, there has been no ruling on the merits of the case, and we will be appealing to have our case heard by the Court as quickly as possible.

The key aspects of our challenge have not changed:

- Central issue – fairness / openness / transparency in how government infrastructure projects are tendered and how workers and construction contractors are treated.

- We are not challenging the collective agreement or any other issue within the jurisdiction of the LRB.

- Government is forcing workers to join unions that it chooses not unions that workers choose, and it is excluding construction contractors whose workers are not organized by their favoured unions.

- If companies are successful in winning government work, their employees should not be forced to:

- Quit their current employer and become an employee of a new government crown corporation;

- Leave their benefits and pension plans behind; and

- Join a union selected by the Government.

- Contractors should not face the risk of losing their employees in a market when one of the biggest issues facing contraction contractors is the shortage of workers.

- 85% of the men and women in B.C. are shut out of government funded projects along with 82% of all registered trades apprentices in the province.

Update from October 24, 2019:

On October 21, BCCA executives and several contractors met in Vancouver with BCIB President and CEO Irene Kerr and members of her staff. The goal of the session was to build a relationship with BCIB and gain a better understanding of their mandate, their goals, and their achievements so far. We also sought to represent the questions, concerns, and interests of the contractors, with the contractors in the meeting leading the bulk of the discussion for the 2 hours. The discussion was respectful and productive, however did not yield any meaningful new operational details about the PLA. We will continue to pursue further details and present industry conerns to BCIB.

Update from early October, 2019:

In early October, 2019 we received word that five days have been set aside by the BC Supreme Court to hear the legal challenge to the CBA/PLA. Those dates are February 3 - 7, 2020. While we are disappointed that so much time must pass before petitioners can be heard, we are confident that our opinion regarding the unconstitutionality of the CBA/PLA will be successful.

Update from September 14, 2019:

The provincial government updated its capital budget this week with 19 new projects and cost increases on existing projects, to a total of $3BN

- None of the 19 new projects fall under the CBA/PLA

- Vaughan Palmer's column on the topic

Update from July 23, 2019:

In a decision issued today, the BC Supreme Court has ruled that the BCCA and our industry partners can proceed through the courts with our challenge to the legal authority of the Government to impose the “Building Trades Only Requirement” on public construction Projects. Read BCCA’s official statement on this ruling.

Update from July 22, 2019:

BC Infrastructure Benefits (BCIB) was invited by Partnerships BC and the Vancouver Regional Construction Association to meet with construction industry representatives for an informal session on July 15, 2019. On July 22, 2019 BCIB released the following Q&A from the session.

Update from May 17, 2019:

The Province has awarded the first construction contract to fall under BC’s new Community Benefits Agreement(CBA)/Project Labour Agreement, and it comes at a hefty cost.

The expansion of Highway 1 at Illecillewaet will now cost $85.2M, an overall project cost increase of $22.3M from the budget announced with the tender in February, which was already $27.9M higher than the original funding announcement of $35M in August 2015. In total that’s a 143% project cost increase. It’s worth noting that the Federal government’s contribution of $15.5M will not grow with the budget, leaving BC taxpayers to cover the $50.2M overage.

Since the CBA/Project Labour Agreement was announced by Premier Horgan in July 2018, BC’s construction industry has expressed significant concern about its impact on cost, competition, and labour supply. Its requirement that all workers on a CBA project become members of a preferred union is believed to be contrary to the Canadian Charter of Rights and Freedoms, and places a heavy administrative burden on a largely free-market industry where 85% of the 180,000 tradespeople are not unionized.

The uncertainty the PLA creates around the labour market is of significant concern to BC’s construction employers. When Premier Horgan announced the PLA last summer he estimated that its introduction would result in a 7% increase to project budgets. Today the government is citing “escalating costs of materials, labour, and the complexity of the work required” as the reason for the 35% budget increase on the Highway 1 project. Industry believes the cost increase to some extent reflects the risk the PLA introduces in the market.

The BCCA and industry partners are awaiting a ruling from the BC Supreme Court in regard to their legal challenge based on the unconstitutionality of the BC CBA/PLA.

Update from March 1, 2019:

In a joint filing, the BCCA teamed with other industry stakeholders, with the “Pattulo Bridge Petition” to ask that the NDP government’s discriminatory building trades union-only hiring procurement policy for public construction projects be struck down on the grounds that it violates the constitutional rights of 85% of BC’s construction workforce.

The BC Supreme Court heard the case between February 27 and March 1, 2019. They advised a decision would be shared by the end of April.

Update from August 27, 2018:

Today, a coalition of stakeholders from the construction industry and the broader business community filed a petition in B.C. Supreme Court asking that the NDP government’s discriminatory building trades union-only hiring procurement policy for taxpayer-funded construction projects be struck down. The legal basis of the challenge is straightforward - the NDP government is exercising its authority for an illegal purpose and, as a result, the constitutional rights of eighty-five percent of the B.C.’s construction workers are being violated.

This is important, not only because of the issues raised in this case, but also, because taking a stand now may help to prevent further roll out of the policy to smaller infrastructure projects, such as schools and hospitals, and draws a line-in-the-sand in the fight against the NDP Government’s anti-business, anti-investment agenda that includes radical changes to the Labour Code, WorkSafe BC, Employment Standards, the major infrastructure project review process, and the tax framework on investment, to name just a few.

The Coalition is made up of the following organizations: the British Columbia Construction Association; the Independent Contractors and Businesses Association; the Progressive Contractors Association of Canada; the Vancouver Regional Construction Association; the Canada West Construction Union; CLAC; the B.C. Chamber of Commerce; and the Canadian Federation of Independent Business.

A number of construction contractors have also joined the Coalition: Eagle West Crane & Rigging Inc.; Jacob Bros. Construction; LMS Reinforcing Steel Group; Morgan Construction and Environmental; and Tybo Contracting.

CBA Background:

Click here to read our article on the Community Benefits Agreement

Click here to see MLA's responses to our letter writing campaign

At the federal, local, and provincial levels, Community Benefit Agreements are gaining traction in government as a way to solve social issues.

Provincially, the government announced on July 16th a new Community Benefits Agreement that is a loosely disguised Project Labour Agreement. The first projects to be delivered under the framework are the new Pattullo Bridge and the four-laning projects on the Trans-Canada Highway between Kamloops and Alberta. Read our CBA 101.

BCCA’s position on Community Benefit Agreements is clear: we strongly oppose any procurement practice or program that seeks to confer exclusive bidding rights to companies based upon any system of quotas or legislated wages within the province. We advocate for a transparent procurement strategy in the public tendering process that allows for fair competition. Read our policies.

Read BCCA's responses to the Community Benefits Agreement and Pattullo Bridge announcements:

- Pattullo Procurement Strategy Takes BC Construction a Bridge Too Far

- Response to the Province’s Community Benefits Agreement Announcement

- BCCA does not support Premier Horgan’s new Community Benefits Agreement

Federally, Bill C-344 (An Act to amend the Department of Public Works and Government Services Act (Community Benefits)) will go before the Senate in Fall 2018. Bill C-344 is very concerning from multiple perspectives:

- It supposes that BC’s construction employers do not already contribute in our communities;

- It assumes that we do not willingly support apprenticeship, training, and equity seeking groups;

- It presumes that contracts are so lucrative that contractors have “plenty more to give away”;

- It expects that the imposition of subjective “benefit” criteria will not have unintended negative consequences for taxpayers;

- It assumes the addition of subjective criteria to the public tendering process does not undermine its integrity or compromise the obligation

BCCA is working with our counterparts at the national and local levels to educate MPs on the risks of this approach.

In Fall 2018 BCCA met with regional members to share opinions on the potential impacts of the BC CBA. The presentation is available for viewing, and includes remarks from the discussions and in-room polling results. Although most contractors feel very strongly that the CBA is not going to be productive for BC, BCCA is preparing policy recommendations intended to achieve desirable outcomes for the stated goals of local, non-traditional hiring and timely, on-budget public sector projects.

Read the BCCA Community Benefits Agreement Town Hall Summary.

Prompt Payment

Lack of prompt payment is one of the most significant issues in the construction sector. When contractors don’t get paid on time, it places a financial burden on small businesses and blocks cash flow in the economy. The estimated cost in BC’s construction sector is $4BN.

Solving the prompt payment challenge in BC will release millions into the economy and improve cash flow for everyday British Columbians across our province. In particular, it will help small contractors (the backbone of our industry) to pay their staff and their bills and manage their business without taking on extra debt and financial expenses.

At BCCA, we’re working with industry stakeholders to introduce Prompt Payment Legislation for BC. We are also working on a technology solution that will create transparency and accountability within a project’s payment ecosystem.

Update from May 13, 2021:

BCCA and 35 industry partners co-signed a letter to Attorney General David Eby restating the need for prompt payment legislation in BC and urging that it be added to the Fall 2021 Legislative Agenda. Read the letter here.

Update from April 1, 2021:

BCCA launches a new podcast series called Inside Construction. Episode 1: Prompt Payment or Bust covers the chronic problem of late payments in construction and how this issue puts contractors across the industry at risk, regardless of their business size, location, role, or labour affiliation. Host Chris Atchison gives the low-down on the issue that costs BC owners an estimated $4BN per year, and talks with four contractors about their experiences and why they support prompt payment legislation in BC.

Update from June 4, 2020:

On June 4, BCCA President, Chris Atchison made a presentation to the Select Standing Committee on Finance re: Prompt Payment, read the full presentation here.

Update January 13, 2020:

On January 10, 2020, The BCCA sent a letter to Mr. Gregory G. Blue, Senior Staff Lawyer at the BC Law Institute, in response to a request for comment on the proposed changes found in the Consultation Paper on the Builders Lien Act. Read the full letter outlining our comments here.

Update August 7, 2019:

After BCCA made recommendations to the Selection Standing Committee on Finance and Government Services that this legislation be developed, the Committee included this recommendation in their unanimous report for the 2020 Budget.

Update May 29, 2019:

Official Opposition House Leader Mary Polak introduced Bill M223 – Prompt Payment (Builders Lien) Act

- M. Polak: This bill will ensure that those who build our province, contractors, subcontractors and workers, are paid in a timely fashion. By setting payment deadlines, we can protect hard-working British Columbians from unexpected and unnecessary financial hardship and minimize payment disputes. If passed, this legislation will require owners to pay contractors within 28 days of receiving an invoice and contractors to pay subcontractors seven days thereafter. Ontario passed similar legislation in 2017, while Alberta, Saskatchewan, Manitoba, Quebec, New Brunswick and Nova Scotia are currently examining this issue.

- MLA Polak’s motion was approved and the Bill will move to second reading.

Update May 21, 2019:

Saskatchewan passed prompt payment legislation in the first week of May 2019. Read more here

Update November 20, 2018:

Congratulations to the Saskatchewan Construction Association for their success in advocating with the Saskatchewan Government for the introduction of changes to the Builder’s Lien Act that will improve protections for contractors in their province. Under the proposed legislation, owners and developers will be required to provide payment within 28 days of receiving a proper invoice for construction services. Contractors will be required to provide payment to subcontractors within seven days of receiving a payment from the owner or developer.

This is a significant win for the industry in Saskatchewan and even further confirmation that BC needs to get on board with the rest of Canada.

Update October 2018:

As of October 2018 Attorney General David Eby has advised BCCA that his office will undertake a consultation on Ontario’s prompt payment legislation, as we requested. The goal is to “be in a position to proceed in the same manner as the Ontario government and make amendments to the lien provisions in the Act at the same time as the prompt payment provisions are added.”

BCCA will continue to advise the Attorney General regarding the urgency of this issue and ensure a timely outcome.

Read the letter sent to Attorney General David Eby.

BC Labour Code Review

On October 25, 2018 the Labour Relations Code Review Panel released their report on Recommendations for Amendments to the Labour Relations Code. The panel was appointed by the Minister of Labour, Harry Bains, and is made up of Michael Fleming (former Assoc. Chair of LRB), Sandra Banister QC (Trade Union Lawyer), and Barry Dong (employer lawyer). It has been more than 15 years since a Panel was convened and a review conducted.

The recommendations have not yet been proposed in the Legislature or passed into law. The period for industry to submit feedback ends November 30. The Minister of Labour reserves the right to introduce additional changes or amendments that deviate from these recommendations.

The BCCA is preparing an official response for submission and will post that response publicly at the time it is submitted.

Update from November 30, 2018

The Labour Relations Code Review Panel released a report detailing 29 recommendations regarding BC’s Labour Relations Code in August 2018. The Panel was appointed by the Minister of Labour, the Honourable Harry Bains. It has been more than 15 years since a Panel was convened and a review conducted. Read the full BCCA Labour Relations Act Review Response here.

Update from May 1, 2019

We are pleased that Minister Bains accepted Labour Code recommendations provided by the Labour Relations Code Review Panel, particularly in regard to maintaining the secret ballot. We also support the proposed updates to the Employment Standards Act, which seek to improve the safety of children and youth in all industries, and enhance protective supports for all workers. Read the BCCA's full statement related to these review decisions.

Update from May 29, 2019

Bill 30, Labour Relations Code Amendment: Green Party Leader Andrew Weaver was instrumental in passing the sub amendment to the Bill introduced by Greg Kyllo, which reduces the “raiding” open period in construction from July and August every year to once every three years only.

BCCA played a significant role in educating Andrew Weaver on the issues of concern to our industry.

- The sub-amendment was passed 44-40

- To quote excerpts from Andrew Weaver in the House today:

- "Over the last few months, my colleagues, staff and I engaged with numerous stakeholders to develop a deeper understanding about the various forces at play in this issue of labour policy. The B.C. Green caucus understands the profoundly unique nature of the construction industry.

- We understand that there are unions like CMAW, like IUOE and others who actually are end-to-end project unions. We know, also, that present rules within the B.C. Federation of Labour do not allow unions to raid other unions in the Federation. So in the spirit of fairness and openness and transparency, this, to us, must be collectively addressed.

- More than anything, we believe, as a caucus, that we must end this ideological tug-of-war that has been allowed to take place in our province for far too long. It is not about union versus employer. We need a level playing field, one that's grounded in evidence, not in ideology."

Agricultural Land Reserves (ALR)

BCCA is concerned that recent ad hoc regulations applied by the Provincial Agricultural Land commission (ALC) that restrict cannabis crops to open field or greenhouse settings but disallow concrete floor or footings, or other conventional construction methods used in any other type of agricultural structure (such as dairy, poultry, other plants) are being discriminatorily applied and resulting in loss of jobs in the construction sector, and placing an undue burden to contractors who have already begun work.

Regarding our outreach to the Ministry of Agriculture on the use of ALR lands and inconsistencies in building requirements for cannabis crops, we received a written response from the Assistant Deputy Minister. The key points from the note are:

- This is local issue

- The provincial government does not plan any changes to the regulations

- We have an option to reach out to the CEO of the ALC

BCCA will pursue a meeting with the ALC CEO Kim Grout. It will be extremely helpful if the regions can provide specific examples from their members as to the projects that have been halted and the impact on jobs, revenue, and taxes. Also, for projects that have been relocated, where have they been relocated to?

Update from January 29, 2019

See the latest here.

Update from May 15, 2019

The provincial government has reversed decisions on Cannabis in the ALR lands, an issue which BCCA recently took before the ALC and Ministry of Agriculture. This regulatory change clarifies that all forms of cannabis production are now considered a “farm use” (see attachment for all details)

- Because all forms of cannabis production are a “farm use”, cannabis production in the ALR does not contravene the ALCA even if engaged in without the Commission’s approval.

- However: the ALR Use Regulation specifically allows local governments to prohibit cannabis production in certain forms ; AND certain other activities associated with cannabis production, such as fill placement or soil removal, may still require proponents to engage with the Commission. (edited)

WorkSafe BC Review

The provincial government has announced a full review of the BC workers’ compensation system to “become more worker centred”.

The review will be conducted by retired labour lawyer Janet Patterson and will assess:

- The system’s policies and practices that support injured workers’ return to work;

- WorkSafeBC’s current policies and practices through a gender- and diversity-based analysis;

- Modernization of WorkSafeBC’s culture to reflect a worker-centric service delivery model;

- The case management of injured workers; and

- Any potential amendments to the Workers Compensation

Act arising from this focused review.

- The province will be conducting a public engagement process to “to ensure that Patterson’s review is informed by feedback from employers, labour organizations and injured workers.”

- BCCA and COCA will work together to ensure the industry is adequately represented

- The report and recommendations will be delivered to government by September 30, 2019.

Update from October 30, 2019

With the WorkSafe BC review report due for submission by Ms. Janet Patterson to the Ministry of Labour on October 31, a co-signed letter from 46 of BC's largest business organizations, including the BCCA, has been submitted to Minster Harry Bains, urging him to provide us with a structured opportunity for feedback, framed by a consultation paper, before proceeding with any legislative changes. You can view the full letter here.

Update from August 15, 2019

In August, BCCA joined 45 of BC’s largest business organizations in pulling out of the Province’s review of WorkSafeBC, saying it was not being conducted in an independent, impartial and balanced manner. BCCA was originally part of a joint submission to the review in July, when it was expected the review would focus on improving worker navigation of injury claims and improving WorkSafeBC performance. Instead, an update received in August made it clear the scope of the review was extremely broad and far-reaching, and largely mirrored recommendations provided by the BC Federation of Labour.

Update from July 17, 2019

The Joint Employer Community Submission to the Workers Compensation System Review being undertaken by BC Government appointed reviewer, Ms. Janet Patterson, has been submitted.

Update August 19, 2020:

Bill 23 Officially passes into law. The new legislation, which introduces changes to the Workers Compensation Act, contains 34 provisions that include housekeeping amendments and changes relating to compensation, assessment, and occupational health and safety matters. This includes the industry contested issue re: presumptive coverage around the contraction of COVID-19. For more information about the Details of Bill 23 click here.

Oil and Gas

Trans Mountain Pipeline Project

BCCA supports the Trans Mountain Pipeline Expansion Project and welcomes Trans Mountain’s recent announcement (Aug. 21, 2019) that work on the project has resumed in B.C. and Alberta. According to Trans Mountain, this will see 4,200 contract workers working along the route in the fourth quarter of 2019. For the apprentices and tradespeople in BC’s industrial, commercial and institutional construction sector, we believe the project represents an opportunity to develop their skills and gain valuable experience, as well as an opportunity to secure meaningful employment that supports their families and communities.

While we recognize that some areas of the project are subject to final regulatory approvals and permits, we support Trans Mountain’s commitment to “prioritizing and maximizing Indigenous, local and regional hiring to the greatest extent possible,” and “ensuring the project incorporates all appropriate measures to protect the cultural, environmental and local Indigenous interests in the lands and waters through construction and into operation.”

On September 4th, 2019, the Federal Court of Appeal ruled that while the project has met its regulatory requirements related to the environment, it is allowing six legal challenges related to Indigenous consultation to proceed while work on the project continues. BCCA's position is that a project of this nature must only take place in a way that respects Canada's commitments to environmental responsibility and meaningful engagement with Indigenous people and organizations.

We are continuing to monitor the project closely and are working with the BC Chamber of Commerce and BC Business Council in their capacity as official interveners on this project.

Update February 4, 2020:

BCCA welcomes Federal Court of Appeal ruling allowing work to continue on Trans Mountain Pipeline Expansion Project.

The BC Construction Association welcomes today’s (February 4, 2020) announcement by the Federal Court of Appeal stating that the federal government did fulfill its duty to consult with Indigenous peoples before approving the project. We believe that a project of this nature must only take place in a way that respects Canada's commitments to environmental responsibility and meaningful engagement with Indigenous people and organizations, and today’s ruling confirms that those commitments have been met.

For the apprentices and tradespeople in BC’s industrial, commercial and institutional construction sector, we believe the project represents an opportunity to develop their skills and gain valuable experience, as well as an opportunity to secure meaningful employment that supports their families and communities.

Update September 4, 2019:

Federal court allows half of Trans Mountain pipeline legal challenges to proceed

Update August 23, 2019:

BCCA welcomes Trans Mountain announcement resuming work on Pipeline Expansion Project

Update August 21, 2019:

Trans Mountain Re-Starts Construction on Expansion Project

Update June 18, 2019:

BCCA Commends Ruling in Favour of Trans Mountain Pipeline Project

Additional Announcements:

Tariffs

Trade wars are a losing proposition. We encourage a focus on more productive trade measures, such as the ratification of the Comprehensive and Progressive Agreement for Trans Pacific Partnerships. The CPTPP is a new free trade agreement between Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. Once the CPTPP enters into force, it will be one of the largest free trade agreements in the world and will provide enhanced market access to key Asian markets. The CPTPP will strongly position Canada to take market share from the US in countries such as Japan and Malaysia: as Canada’s western gateway BC will play a key role in “export diversification” to Pacific partners.

Working with BC’s Ministry of Jobs, Trade, and Technology, the Trade Policy and Negotiations Branch, and the International Strategy and Competitiveness Division, BCCA urges the federal government not to impose tariffs on construction materials. Read the letter sent to Bruce Ralston Minister of Jobs, Trade and Technology. The costs of construction are already high, and have been rising for some time. Margins are low for developers and contractors, and housing is already unaffordable for many British Columbians: tariffs on steel, iron and aluminum, which are crucial materials for construction, will just make these situations worse.

BC has big energy projects underway such as Site C and the LNG Canada facility in Kitimat. Steel is important in every part of the oil and gas industry, from drilling, production, processing, to storage and transportation utilizing pipelines. Tariffs on products which are of particular relevance to the oil and gas sector will add increased risk to final investment decisions on major projects that are enormously important to BC’s economy.

As of October 1, 2018 NAFTA is replaced with the USMCA – but the tariffs on steel (25%) and aluminum (10%) remain under Section 232 national security grounds.

Update October 16 – The Canadian government rejected our industry’s call for provisional safeguard measures to be imposed on steel products. CCA Press Release.

We continue to align with our provincial government and colleagues at Canadian Construction Assosciation (CCA) to press the federal government for complete repeal of all US tariffs of Canadian steel and aluminum. This week, Prime Minister Trudeau confirmed he pressed the matter with President Trump in France over the weekend and expressed a desire to conclude the ongoing dispute before the G20 in Argentina in late November. Canadian ambassador to the United States David McNaughton has also affirmed that talks are to resume with the US Trade Representative this week.

The Federal governement has taken two major steps in October:

Remission Order/Remission of Surtaxes

On October 11, Canada’s Department of Finance announced targeted relief from surtaxes collected on certain steel and aluminum imported from the US. Targeted relief is granted when a company can demonstrate extraordinary circumstances such as a lack of supply in the domestic market. Companies that have applied for and been granted relief can now import these goods without paying surtaxes. Some of this relief might be temporary, until such time as Canadian producers can meet domestic demand. Note that companies that want Duty Drawback or Duty Relief are under a significant administrative burden. Contact: 1-800-461-9999 (CBSA Border Information Service)

Duty relief programs:

Other than remission of surtaxes under the Order, relief from the surtaxes may be available under existing duty deferral programs administered by the CBSA.

- The Duties Relief Program relieves from the payment of surtaxes on imported goods from the U.S. if the goods will eventually be re-exported either in the same condition or after using, consuming or expending them to process other goods.

- The Drawback Program has the same advantages as the Duties Relief Program. The only difference is that the Drawback Program is for companies who have already paid the surtaxes and are asking for a refund of those surtaxes.

Contact: Your local CBSA office

Export Development Canada:

Export Development Canada (EDC) has made up to $900 million available over the next two years in commercial financing and insurance to companies in the steel and aluminum sectors and related industries including SMEs.

Contact: 1-888-220-0047 or tradeadvisor-conseiller@edc.ca

Additional resources EDC - Commercial financing and insurance

Safeguards:

Also on October 11, the Canadian government announced provisional safeguard measures on seven steel products: heavy plate, concrete reinforcing bar, energy tubular products, hot-rolled sheet, pre-painted, steel, stainless steel wire, and wire rod. The government did this citing evidence that foreign steel products are being diverted into Canada. The safeguard is intended to curtail the diversion of foreign steel: beginning October 25, imports of these seven steel products will be subject to a 25% surtax in cases where the level of imports exceeds historical norms. These safeguards are under review and in place for 200 days.

Update November 23, 2018:

The Trade Policy and Negotiations Branch of BC’s Ministry of Jobs, Trade and Technology is seeking urgent input from industry on the provisional safeguard measures on certain steel products. Information collected will be used to inform BC’s submission to the Canadian International Trade Tribunal (CITT's) Inquiry.

Thank you to all who provided input by the deadline of November 28, 2018. BCCA was able to provide feedback from 131 BC contractors: your input is highly valued and crucial to informing government of the needs of our industry.

View the Industry FeedbackUpdate from November 30, 2018

Leaders of Canada, Mexico and the USA signed a new NAFTA agreement at the G20 summit in Argentina. The agreement still needs to be ratified by the governments of all three countries but it is a powerful first step. A key provision requires that 75% (up from 62.5%) of automotive parts are made in the region to qualify for tariff free treatment, and that workers are paid $16 hour (down from $22) on 40-45% of the vehicle. This move is intended to boost North American auto production and stop plants from moving to Mexico. It also means Canada escapes the national security tariffs on automotive imports that President Trump was threatening.

How does this impact steel tariffs? In June, when the US imposed tariffs on steel and aluminum imports from Canada, Mexico, and Europe, they said it was tied to lack of progress on NAFTA. This new NAFTA deal opens the door to resolving the tariffs, which Trudeau says is a priority for both governments.

Update from December 20, 2018

In direct response to the concerns of BC’s construction industry the Canadian Federal Government today announced it will exclude some imported steel and aluminum products from its newest import tariffs and quotas, as well as provide relief for specific companies facing unique circumstances and for steel products already in transit prior to October 25, 2018.

This outcome is widely attributed to coordinated advocacy efforts between BC’s construction industry and the government: activity which includes significant contributions and leadership from CCA, BCCA and the RCAs.

“This announcement demonstrates the important role that Associations play in our industry, and the power of local, provincial, and national organizations collaborating together on key issues. The Ministries of Finance at the national and provincial levels heard and respected the concerns of industry, and recognized the need to minimize the significant impacts of federal trade initiatives in our specific industry and region” comments Chris Atchison, BCCA President.

BC is uniquely dependent on imported steel and aluminum products due to its geographic location and undersupply of local producers. The Canadian tariffs were imposed on July 1, 2018, in response to actions taken by the United States.

Update April 18, 2019:

The Canadian International Trade Tribunal (CITT) inquiry into whether international imports on any of the seven categories of steel products were significant enough to keep the October 2018 safeguards in place has concluded.

- The report found that only heavy plate and stainless-steel wire have been “imported in such increased quantities and under such conditions as to be a principal cause of threat of serious injury to the domestic industry”

- The Tribunal recommended that safeguard remain in place for only those 2 products until a Ministerial decision is reached

- Surtaxes on the other five products will stop on April 28, 2019

- Minister Morneau has until mid-May to render a decision on the 2 outstanding categories.

- The CCA, on behalf of the provincial and regional Associations, “advocates for a final and binding end to the ongoing dispute with the US”

Update May 17, 2019:

The BC Construction Association welcomes the news of the lifting of the steel and aluminum tariffs and the end of the nearly year-long standoff with the US. Allowing our industry to move forward with the restoration of free and unencumbered trade with the US will add confidence to our economy and assist with the competitiveness of our sector within our province. The BC Construction Association commends the efforts of the Canadian Construction Association on this important national advocacy file as they leaned-in alongside and on behalf of their provincial and regional construction associations.

Update August 6, 2020:

Less than one month after the new NAFTA took effect (known as USMCA - the US-Mexico-Canada Agreement), US President Trump is imposing a 10% Tariff on Canadia aluminum. Read article for more details.

Update September 15, 2020:

The US has opted to pull back on the recently imposed 10% aluminum tariff on Canada. This happens on the day that the Canadian Government was set to announce retaliatory tariffs allowing us to maintain a trade truce for now. Read full story

BCCA Responds to Federal Budget

The Federal Budget 2019 was announced on March 20.

- A commitment to introduce prompt payment legislation, following the example set in Ontario

- A plan to introduce a tax credit of $250 per year per worker contribute to the costs of occupational skills training, to a cap of $5000 (this amounts to $250/year for 20 years)

- The introduction of an EI Training Support Benefit designed to cover employees’ living expenses for up to four weeks when they’re on training leave. Details yet to be worked out.

- An EI Small Business Premium Rebate to help offset the costs of the new program to small businesses (although the CFIB cautions that the program would end up subsidizing training that doesn’t help employers)

- $2.2BN top-up of the Federal Gas Tax Fund in support of municipal infrastructure

- First-time home buyer incentive

- $35M towards a permanent Global Talent Stream program to help Canadian companies hire skilled overseas workers when no Canadians are available to fill needed jobs

“We’re always glad to see a focus on training and a continued commitment to infrastructure investment, but BC construction employers are dealing with unique challenges at a time of significant construction activity. The Federal budget nods towards industry hot buttons but doesn’t go far enough – a notable exception being the commitment to prompt payment legislation, which we haven’t seen yet from our provincial government.” Says BCCA President Chris Atchison. “ BC contractors need meaningful and tangible solutions today to operational challenges like steel and aluminum tariffs, small business taxes, the flow of federal dollars on infrastructure projects, and skilled workforce – it’s essential for them to remain competitive in this market. For those new policies that are undefined, such as EI Training Support Benefit and Small Businesses Premium Rebate, we certainly would expect that industry be invited to help shape the details.”>

Tax Increases on Small Business

BCCA is a Member of the BUSINESS COUNCIL OF BRITISH COLUMBIA, and we work in close partnership with this council on issues that impact all industries in BC (vs those issues that are uniquely important to construction): small business taxation is one of those issues.

We are working together to create awareness of government actions that are resulting in increasing complexity, cost, and time for business. We believe the taxation changes are adding to uncertainty and eroding competitiveness in many industries through uncoordinated layering of more regulations, taxes and volume of change.

Some of the recent budget activity can be found here:

- BCBC offers mixed reviews on Budget 2018

- Avoiding a deficit should be a BC NDP coalition budget priority (BIV)

- Budget’s higher business costs dim BC investment prospects

- Pros & Cons of NDP’s Housing Plan

- New age of activist governments driving up costs of doing business(BIV)

- BC Budget 2018 - Higher Business Taxes Plus Additional Spending Measures

In support of CCA’s efforts at the Federal level, BCCA provied this letter.

SPECULATION TAX

We are concerned that the “Speculation Tax” introduced in the February 2018 provincial budget will create uncertainty in the market and lead to a slowdown in construction on new developments: we continue to monitor the impact closely in partnership with other industry stakeholder organizations. This concern is heightened when taken into consideration with the other measures aimed at cooling BC’s real estate market, such as the increased foreign buyers tax (from 15% to 20% of fair market value), and the expansion of the geographic areas of the tax to include the CRD, Central Okanagan, Fraser Valley, and Nanaimo Regional District.

EMPLOYER PAYROLL HEALTH TAX

The BC Government proposed the EHT in February 2018 budget, along with the elimination of the MSP premiums effective January 1 2020. BCCA is concerned that construction employers with payrolls of $500,000 annually or more are being unfairly burdened with yet another tax as a result of a transferring the cost of the health care system to their bottom line.

Update from March 30, 2019

- The EHT came into effect January 1, 2019.

- Employers with payrolls of $500,000 must pay EHT.

- This amounts to an increased cost burden per employee, adding to the cost of performing work under construction contracts and subcontracts.

- Only one exemption amount may be available for each calendar year, not per project/contract. This information is provided to BCCA by the Provincial Income Taxation Branch from the Ministry of Finance.

- Contractors who are associated with another group of employers will share the annual exemption

On behalf of members, BCCA sought legal counsel to confirm that the increased cost may be claimable under a contract or subcontract, in the context of CCDC 2 (Stipulated Price Contract) or CCA 1 (stipulated price subcontract). While this was confirmed by counsel, the following cautions must be duly considered:

- Each circumstance may be different, depending on the nature and terms of each contract or subcontract. Contractors and subcontractors must review their documents closely in each case.

- If, after careful review, a contractor or subcontractor decides to claim the increased costs incurred as a result of EHT, the claims related to the increases costs are pursuant to paragraphs 10.1.2 (taxes and duties) and 10.2.7 (laws, notices, permits, and fees)

- There is no guarantee that such claims will be successful.

- It is highly recommended that legal advice be obtained prior to making such a claim, to ensure appropriate interpretation and application of the contractual terms related to the costs resulting from the EHT.

- Employers should register for their accounts by May 15, 2019

- Contractors with bids that closed prior to January 1, 2019 should make a claim following the process under CCDC 2 (GC 6.6) and CCA 1 (SCC 6.6)

- The first quarterly installment is due June 15, 2019 for all companies who’s estimated liability is greater then $2,925 based on their previous calendar year

This calculator helps employers estimate their liability. Try the calculator!

Compulsory Trades

Update June 21, 2021:

In our role as the only provincial representative of all employers in BC's industrial, commercial, and institutional construction industry, BCCA was at the table with government and other industry leaders to ensure all opinions on compulsory trades were adequately represented. Read BCCA's official statement here.

Update October 24, 2019:

During the week of October 14, Chris Atchison, President of the BCCA, attended a discussion about compulsory trades, or mandatory certification, as part of an invitation-only "Stakeholder Advisory Working Group" led by the BC Ministry of Advanced Education and the Ministry of Labour.

Update November 28, 2018:

In November 2018 the BC Federation of Labour announced that it would lobby the NDP government to bring back “compulsory trades”, a move which would bar employers from hiring tradespeople who don’t hold official Red Seal certifications.

In 2003 BC introduced a modularized trades training system, and the Industry Training Authority (ITA) was introduced to govern this system. To become a certified journeyperson, workers must still complete an apprenticeship, but the BC system no longer included “compulsory trades”. These are trades that only allow certified journey people or indentured apprentices to practice. Prior to 2003 there were 11 compulsory trades in BC.

Stringent requirements remain in place to ensure that the work is done to a high level of skill and safety, for example through the work of Technical Safety BC. Obtaining a Certificate of Qualification from Technical Safety BC provides assurance that tradespeople have the knowledge and ability to do regulated work in the province. The Safety Standards Act defines the scope of regulated work within the specific certificate.

Advocates of the current BC system like it because:

- It decreases training time requirement, making it easier to attract people to the trades

- Apprentices have more flexibility in pursuing types of specialization within their trade

- Employers can play a more active role in identifying skill requirements for their apprentices

Opponents of the BC system say:

- compulsory trades make the industry safer

- the quality of work is higher

- BC should align with the rest of Canada

The Council of Construction Associations (COCA), which represents 20 BC construction associations from every sector, company size, and labour affiliation, has confirmed that from a health and safety perspective the compulsory trade requirement has no impact. COCA has reviewed safety data from across Canada and has found no safety correlation. This is because the Worksafe BC health and safety regulations apply universally to all employers, workers, and job sites. The worker is therefore protected in either context: the result is that BC has the same safety record as other provinces that have compulsory trades.

The most measurable impacts of the BC system have been an overall increase in registered apprentices but a decrease in apprenticeship completions.

The BCCA strongly supports training and has always been a proponent of apprenticeship: 85% of our members hire and train apprentices, and we operate some of the most innovative and far-reaching training initiatives in Canada. We know the right training is essential for safety and career development.

However, adding new barriers to entering the skilled trades may not be a productive course for our industry or for BC’s economy as a whole. Here’s why:

- BC’s construction industry is facing a skills shortage of at least 11,000 workers: likely as many as 19,000 now that the LNG Canada project is confirmed.

- Unemployment in BC is at generational lows in construction and most other industries. Job seekers have many options: we are competing with all of them.

- The majority of BC’s construction employers (80%) have ten employees or less, limiting their operational capacity to participate in the apprenticeship system.

- Most Level 1-4 training programs for apprenticeable trades are already operating at near or full capacity. Waitlists can already be as long as one year.

- There is no measurable difference in safety outcome between provinces with compulsory trades and BC.

Trade unions require apprenticeship of all dues paying members and offer apprenticeship training programs: they are highly supportive of the re-introduction of compulsory trades. Large employers have greater capacity to support apprenticeship programs and will not be unduly impacted by a return to compulsory trades. However the industry as a whole - and small employers in particular - may be challenged to adopt compulsory trades, especially given the current level of construction activity and shortage of labour supply in the sector.

BCCA supports a fair, flexible solution that achieves a high standard of skill and safety without over-burdening workers or their employers with unnecessary barriers. We represent employers from all labour affiliations and seek to ensure a productive and resilient industry for all.

Cannabis

BCCA supports the maintenance of a safe and healthy workplace and the construction safety measures through our active involvement with COCA and WorkSafe BC. We support the establishment of any additional programs to promote excellence in construction safety, including those that regulate substance abuse of any kind. We are actively involved in ensuring that rules and regulations around cannabis use are clear to employers and employees, and align with the Workers Compensation Act s.116 that says “every worker must ensure that the workers ability to work without risk to his or her health or safety, or to the health or safety of any other person is not impaired by alcohol, drugs or other causes.”

We advise employers to apply the same rules and policies to cannabis use as they have done for decades in regard to alcohol use: zero tolerance.

We also stress that firms have a duty to accommodate. “Duty to accommodate” is a legal requirement drawn from human rights legislation and Canadian case law which says an employer should reasonably accommodate an individual’s difference, which would include addiction, to the point where doing so does not cause undue hardship to the employer. In terms of enforcement, don’t focus on the substance as much as the ability to work safely.

WorkSafeBC has a Primer that details what requirements are for workers and for employees, as well as a landing page around workplace impairment specifically for the lead up to legalization.

Environmental Assessment Overhaul and Bill C-69

There is potential for significant impacts on construction projects if the environmental assessments change. BCCA is looking for consistency and confidence when it comes to major infrastructure projects. Clearly we don’t have that in Canada right now. The post-decision second-guessing is destructive on many levels: if every time a government changes we question another multi-million or billion dollar project, nobody wins. Therefore, we support an overhaul that results in an efficient and predictable environmental assessment process.

That said, rushing the new Federal Bill C-69 through without industry consultation is not the right approach. We hope that any changes that are made will be the result of due diligence and consultation with the sectors that will be the most impacted – including construction.

We also urge Environment Minister George Heyman to consult with the construction industry in regard to the BC review currently underway.

BCCA supports processes to ensure that the assessments are done to a high standard, so that when a decision is made to build, that decision is trusted, is final, and has the best interests for British Columbians as its priority.

We need to make sure that Environment ministers have the appropriate scope and cannot stop a project on their own opinion. Everything must be done in consultation with stakeholders, preferably long before a project is greenlit.

We also support the idea of legislated timelines to make sure these assessments are implemented with consistency and dependability in order to plan for these major construction projects.

Update May 21, 2019:

We continue to urge Environment Minister George Heyman to consult with the construction industry in regard to the BC review currently underway.

Opioids

BCCA supports the maintenance of a safe and healthy workplace and the construction safety measures through our active involvement with COCA and WorkSafe BC. We support the establishment of any additional programs to promote excellence in construction safety, including those that regulate substance abuse of any kind.

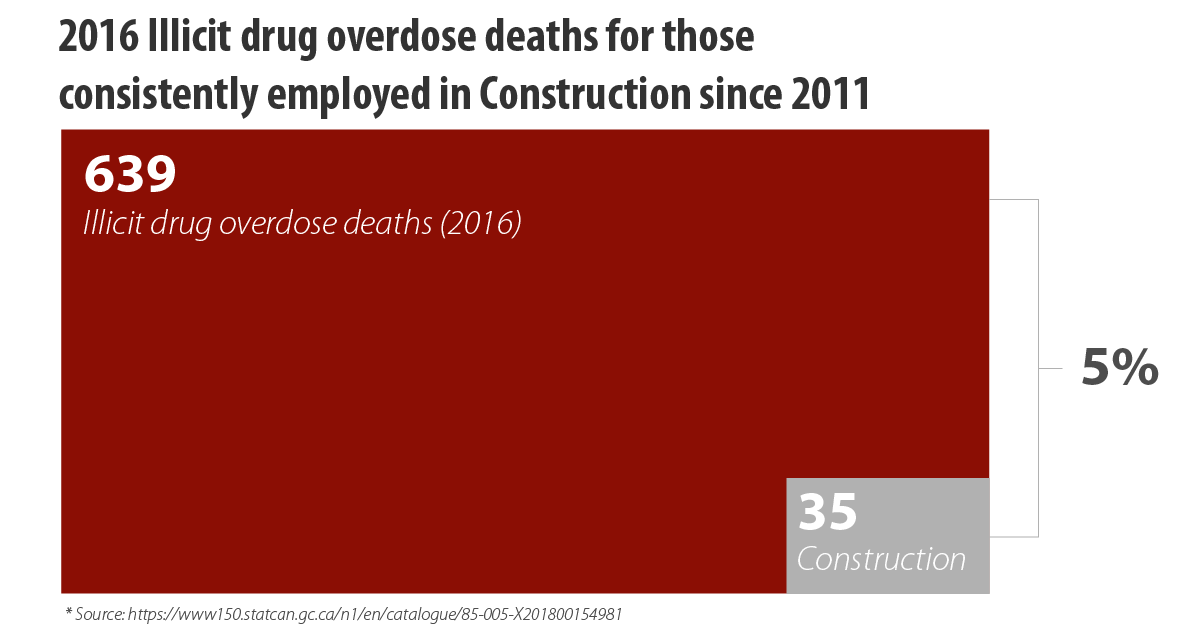

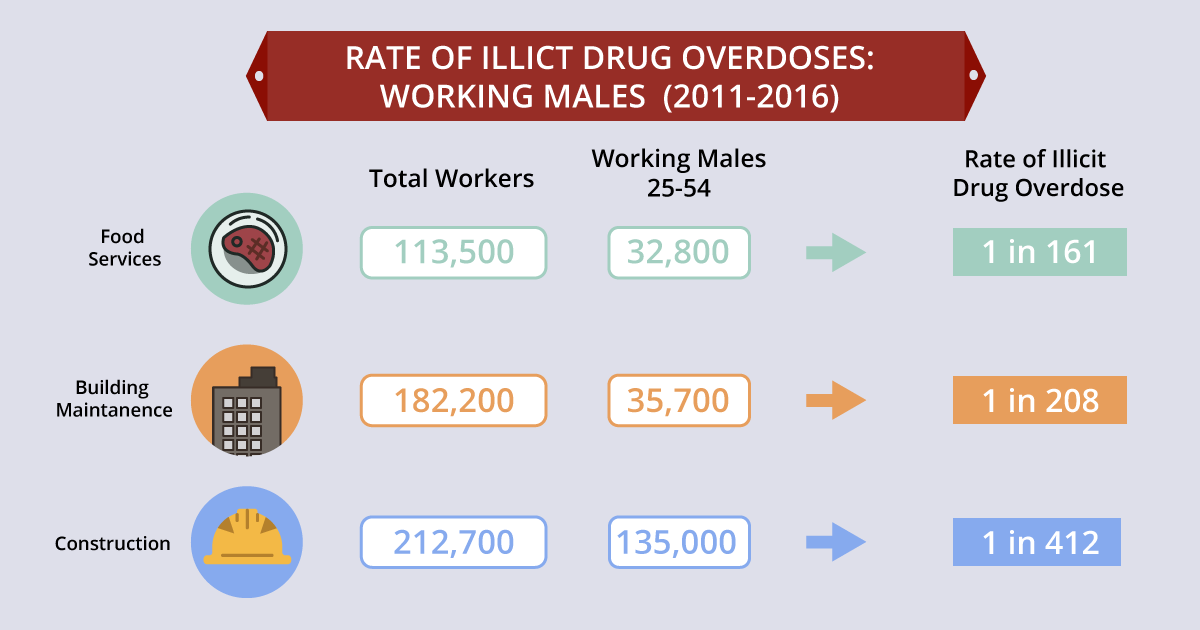

Many jurisdictions across Canada are struggling to manage opioid addictions within their communities. BC is no exception. The construction industry can be an important influencer in this battle, because the demographic composition of our workforce - adult males – aligns with demographic profile of the majority of those suffering from opioid addiction. However, we have seen no evidence to support broad claims in the media that the construction industry has a higher incidence rate than other industries. This is an important distinction as we strive to attract new entrants to the construction sector, recognizing that decades of negative stereotypes continue to play a key role in a persistent cultural bias that discourages desirable candidates from considering our industry.

BCCA attended the first “Industry Roundtable” in August 2018 hosted by BC’s Minister of Mental Health and Addictions Judy Darcy to learn more about this epidemic and how we can play a part in the solution without unnecessarily and unfairly stigmatizing our industry.

Public Sector Construction Procurement Practices

BCCA is focused on developing public sector procurement capacity and improving access to high quality project information through our BidCentral platform.

In the public sector, we believe that adherence to the Capital Asset Management Framework (CAMF) is essential to the fair, open, and transparent procurement process that is an obligation and responsibility of government to taxpayers.

Success rests on a contractor’s ability to access high quality project information from any region in BC, and on an owner’s ability to receive multiple compliant and professional bids from quality local contractors.

BCCA will continue to support BC’s public sector by offering the highest level of industry knowledge and expertise available. Recent advocacy efforts include:

We continue to work with the Ministry of Citizen’s Services to support their procurement innovation strategy and the re-visioning of BC Bid to ensure that the unique needs of construction are met.

Update August 30, 2021

Read the BCCA letter to the City of Vancouver in relation to the City of Vancouver's current permit crisis, and its impact on BC's construction industry.

Update May 3, 2021:

Listen to Epidose 2 of BCCA's Podcast Series Inside Construction "Fear, Open, and Trasparent" In this episode we look at the corrosion of public sector procurement standards, explore why today's procurement practitioners may be bending the rules, and explain how ignoring best practices puts projects at risk. Host Chris Atchison gives the low-down on the issue that's becoming a top concern for BC's ICI industry, and talks with experts about how to fix it

Update April 28, 2021:

Read the latest Construction File released by the BCCA on April 28, 2021 titled: Building Back Smarter - Restoring Confidence in BC's Public Procurement Methodology for Construction Services.

Update August 9, 2019:

The BCCA has issued a Freedom Of Information (FOI) request to BC Parks for construction services on improvements at Little Qualicum Falls. The request was made in partnership with the Vancouver Island Construction Association (VICA).

- A second FOI request will be going to the Ministry of Forests, in partnership with the Northern Regional Construction Association (NRCA).

- The intent of these requests is to improve access to project information from Public Owners.

- We will work with the BCCA Standard Practices (SP) committee on a longer term plan, informed by the results of these first two efforts.

- The Parks FOI request is asking for:

- Company name and amount of contract award for successful respondent

- Bid/Tender Amounts

- Names of Companies who responded to the solicitation for Construction Services

- List of Company Attendees at Site Visit

- List of Plan holders

Update July 5, 2019:

In response to recent contractor alerts for 'Onerous Bidding Conditions' on two Prince George construction projects being procured by BC Housing, the BCCA has been closely consulting with BC Housing, the most recent meeting being at the end of June. As a result of these consultations we can report that the following changes will be implemented by BC Housing on August 2:

- SGCs: Increase C/O markup on CCDC SGCs from 10%/5% to 15%/7.5% (Action 26)

- Update ITT reserved rights per changes proposed 16 May (Action 7, 14, 15,16,17,21,22)

- Update ITT to replace “scoring” with “evaluation” per changes proposed 16 May (Action 8)

- Update ITT to identify only top 5 subcontractors per changes proposed 16 May (Action 12)

- Update ITT to include a minimum 7 day extension for addenda issued after the deadline per changes proposed 16 May (Action 20)

- Update ITT to revise Governing Law clause per changes proposed 3 Jun (Action 23)

Update May 21, 2019:

BCCA issued two Contractor's Alerts warning BC contractors of "Onerous Bidding Conditions" on two Prince George construction projects being procured by BC Housing.

Update April 9, 2019:

BCCA hosted a number of Ministry and Construction Employer Leaders for a Capital Asset Management Framework (CAMF) Breakfast during Construction Month. You can view the discussed topics in this presentation.

Safety

Update September 18, 2020:

Chris Atchison, President of the BCCA, receives letter. from Minister Harry Bains addressing the concerns around the presumptive coverage elements of Bill 23, passed into law earlier in August, despite Industry concerns around the scientific and medical research not supporting this element.

Update August 19, 2020:

Bill 23 Officially passes into law. The new legislation, which introduces changes to the Workers Compensation Act, contains 34 provisions that include housekeeping amendments and changes relating to compensation, assessment, and occupational health and safety matters. This includes the industry contested issue re: presumptive coverage around the contraction of COVID-19. For more information about the Details of Bill 23 click here.

Update July 24, 2020:

In response to WorkSafeBC considering the altering of hardhat regulation in deference to religious freedom, the BCCA has sent a letter to WorkSafeBC. stating our position. BCCA and its partner COCA fully respect religious freedom, however, we are concerned that this change will come at the expense of site safety and human life.

Update July 22, 2020:

Read the BCCA letter to Minister Harry Bains, voicing industry concerns with regards to the presumptive coverage elements outlined in Bill 23 (Workers Compensation Amendment Act 2020) Read letter.

Update April 16, 2020:

A letter to Premier John Horgan and Prime Minister Justin Trudeau from a coalition of representatives of the BC Construction Industry including BCCA. Re: COVID-19 Recovery - Infrastructure Stimulus Spending.

Visit BCCA's Construction Briefing: COVID-19 for ongoing updates surrouding this global pandemic and its impacts on construction.

BCCA is a founder and major funder of the Council of Construction Associations, an industry stakeholder group that leads our advocacy efforts to ensure safety standards and protections are upheld and kept up-to-date across our provincial industry.

BCCA is a major contributor to the governance of the BC Construction Safety Alliance, an industry non-profit working to develop health and safety programs to ensure the health and well-being of our industry’s workforce.

Resources:

Skilled Workforce Development

Update June 3, 2020:

BCCA and industry partners have submitted a letter to Prime Minister Justin Trudeau, conveying the BC construction sectors support for temporary sick pay coverage during the COVID-19 pandemic.

Skilled Workforce development is a cornerstone of BCCA’s strategic plan. For decades, BCCA has prioritized apprenticeship and managed many programs helping employers attract, develop and retain the skilled workers they need. We facilitate access to training and other resources to ensure the workforce reflects the diversity of our population. We believe that everyone should have equal opportunity to pursue and achieve a successful and rewarding construction career.

Our provincial skilled workforce programs include:

- STEP

- LNGC Trades Training Fund

- LNG Canada Connect Program

- TransCanada Coastal Gas Link Connect

- BCCA Integrating Newcomers

- Builders Code

Read our stated policies on these issues:

Skilled Workforce Shortages

BCCA has been a leader in developing our provincial skilled workforce for decades. According to BuildForce Canada’s latest report, BC can expect a shortage of 14,000 skilled tradespeople over the next few years*. Competition for skilled tradespeople and labourers is fierce and wages and benefits reflect the tight supply. This translates to increased costs on most projects.

BCCA manages several programs and services to alleviate the pressure by helping employers find the high quality employees they need and support them in training and career development:

These numbers do not yet include the LNG Canada Facility in Kitimat, which will bring 10,000 jobs and targets 2,500 apprentices.

- Skilled Trades Employment Program

- LNG Canada Trades Training Fund

- LNG Canada Connect

- TransCanada Coastal Gas Link Connect

- Construction Workforce Equity Project

- Integrating Newcomers

USMCA (previously known as NAFTA)

The October 1, 2018 announcement naming the “US Mexico Canada Trade Deal” (USMCA) as the successor to Canada is welcome progress in the challenging new relationships between the US and Canada. However, we are gravely concerned that the tariffs on steel (25%) and aluminum (10%) remain under Section 232 national security grounds.

BCCA supports the agreement overall and urges all ratification, but with removal of the steel and aluminum tariffs.

Find previous Advocacy Issues here.

Stay up to date on all Advocacy Issues

Click the link below to sign up for our BCCA Newsletters, be sure to check the Advocacy box!